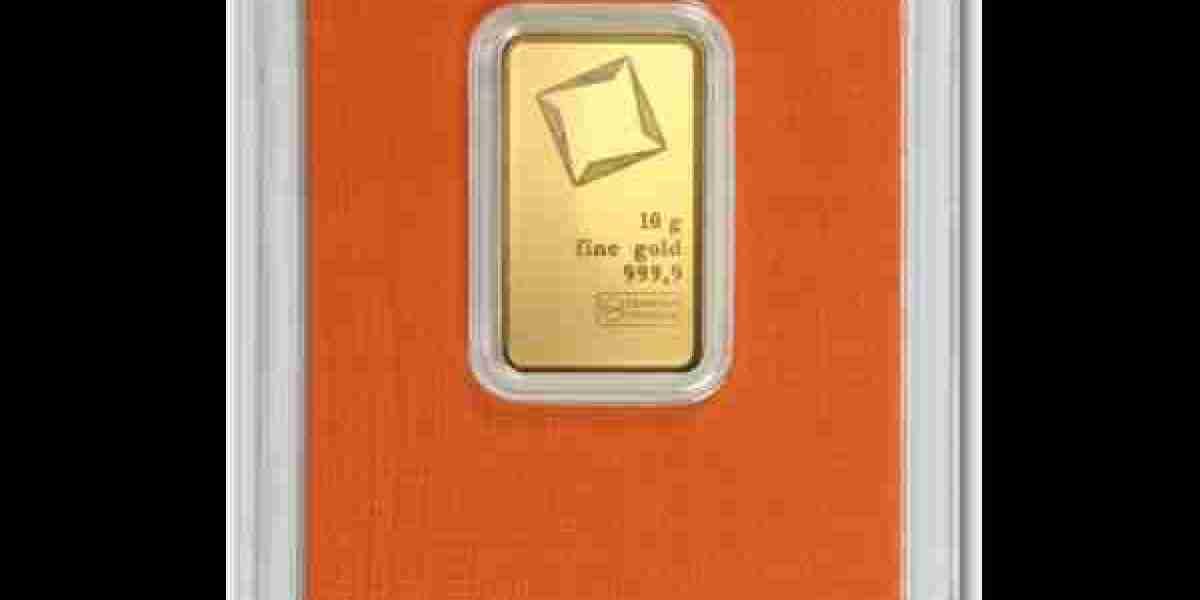

Gold has long been revered as a stable investment and a symbol of wealth. Among the various forms of gold available to investors, the 10g minted gold bar stands out as a popular 10g minted gold bar choice due to its accessibility, purity, and compact size. Whether you’re a first-time investor or looking to diversify your portfolio, the 10g minted gold bar offers a practical and valuable way to own physical gold.

What is a 10g Minted Gold Bar?

A 10g minted gold bar is a small, rectangular piece of gold that has been precisely cut and stamped to meet high standards of weight and purity. Unlike cast gold bars, which are poured into molds and often have a rougher appearance, minted gold bars are manufactured with a smooth, polished finish. This makes them not only an investment but also a visually appealing asset.

Why Choose a 10g Minted Gold Bar?

Affordability: One of the primary reasons investors choose the 10g minted gold bar is its affordability. Weighing just 10 grams (approximately 0.32 ounces), it represents a smaller financial commitment compared to larger gold bars. This makes it an ideal choice for new investors or those who want to add gold to their portfolio without spending a significant amount of money.

High Purity: Most 10g minted gold bars are made of 24-karat gold, with a purity of 99.99% (999.9 fine gold). This high level of purity ensures that you are acquiring a product of exceptional quality, which will retain its value over time. Reputable mints like PAMP Suisse, Valcambi, and the Royal Mint produce 10g gold bars that meet these exacting standards.

Portability and Storage: The small size of the 10g minted gold bar makes it highly portable and easy to store. It can be kept in a home safe, a bank deposit box, or a professional storage facility. Its compact nature allows investors to accumulate gold in a manageable and secure manner.

Liquidity: Despite its small size, the 10g minted gold bar is highly liquid. It can be easily bought and sold in global markets, making it a flexible asset for investors. Whether you need to liquidate your investment quickly or want to trade it for another asset, the 10g gold bar offers versatility and ease of transaction.

Gift Potential: The 10g minted gold bar also makes an excellent gift for special occasions such as weddings, anniversaries, or birthdays. Its compact size and attractive design make it a meaningful and valuable present that can be cherished for years to come.

How to Determine the Price of a 10g Minted Gold Bar

The price of a 10g minted gold bar is determined by several factors:

Spot Price of Gold: The most significant factor influencing the price is the current spot price of gold, which fluctuates based on global economic conditions, supply and demand, and geopolitical events. The price of a 10g minted gold bar is directly linked to the spot price, with the cost being calculated by multiplying the spot price by the bar’s weight.

Premiums: In addition to the spot price, a premium is added to the cost of a 10g minted gold bar. This premium covers the cost of production, refining, and distribution, as well as the brand’s reputation. Minted bars, with their precise craftsmanship and polished finish, often carry a slightly higher premium compared to cast bars.

Brand and Design: The brand of the gold bar can also influence its price. Bars from well-known mints such as PAMP Suisse or Valcambi often command a higher price due to their reputation for quality and authenticity. Additionally, bars with unique designs or limited editions may also be priced higher.

Where to Buy a 10g Minted Gold Bar

When purchasing a 10g minted gold bar, it is essential to buy from a reputable dealer to ensure you receive an authentic product. Look for dealers who provide a certificate of authenticity, 10g minted gold bar which guarantees the weight, purity, and origin of the gold bar. Many investors prefer to buy directly from well-known mints or authorized dealers to avoid the risk of counterfeit products.

Storing Your 10g Minted Gold Bar

Proper storage is crucial to maintaining the condition and value of your gold bar. While gold is a durable metal, it should be stored in a secure, dry environment to prevent any potential damage. The small size of the 10g bar makes it easy to store in a safe at home, a bank deposit box, or a professional vault. Many bars come sealed in tamper-evident packaging, which can further protect them from scratches or environmental factors.

Conclusion

The 10g minted gold bar is a smart and accessible investment option for those looking to own physical gold. With its high purity, portability, and liquidity, it offers a valuable addition to any investment portfolio. Whether you’re just starting out or looking to diversify your existing assets, the 10g minted gold bar provides a tangible and secure way to invest in gold. By choosing a reputable brand and ensuring proper storage, you can enjoy the benefits of this compact and precious asset for years to come.