n Once permitted, funds from prompt loans may be transferred to your bank account inside minutes to a few hours, relying on the lender's insurance policies.

n Once permitted, funds from prompt loans may be transferred to your bank account inside minutes to a few hours, relying on the lender's insurance policies. Some providers even supply immediate disbursement, permitting you to entry money nearly instantly after appro

To find respected lenders for quick money loans, you should use online platforms corresponding to Be픽 that aggregate and analyze numerous

Loan for Bankruptcy or Insolvency products. Look for lenders with constructive buyer critiques, transparent terms, and

이지론 clear companies. Always confirm the lender's license and regulatory compliance to ensure they operate legally and ethica

Thus, people ought to weigh these pros and cons rigorously, guaranteeing that an installment loan aligns with their financial technique and capacity for repayment. Making knowledgeable choices can result in improved credit score health and larger monetary stability in the long

Moreover, instant loans on-line can offer flexibility in phrases of borrowing quantities. Whether a borrower wants a small sum for an sudden bill or a bigger quantity for a extra significant expense, these loans usually accommodate numerous wants, making them an appealing alternative for m

The Benefits of Quick Approval Loans

One of the primary benefits of fast approval loans is their *speed*. Borrowers typically obtain funds inside a couple of hours and even minutes after approval, which can be lifesaving in emergencies. This quick entry allows individuals to handle their funds more successfully and avoid potentially pricey consequences of delayed payme

Potential Drawbacks of Debt Consolidation

Despite the advantages, debt consolidation loans usually are not with out drawbacks. Borrowers could face hidden charges or excessive rates of interest, particularly if they don't store round totally. It’s crucial to learn the nice print to understand the terms of the loan absolut

In recent years, the rise of online lenders has made obtaining quick cash loans even easier. Borrowers can full purposes from the consolation of their properties, providing private information and financial particulars to facilitate quick approvals, sometimes inside hours. However, with comfort comes the need for warning as not all lenders could be trus

Exploring BePick for Instant Loans Information

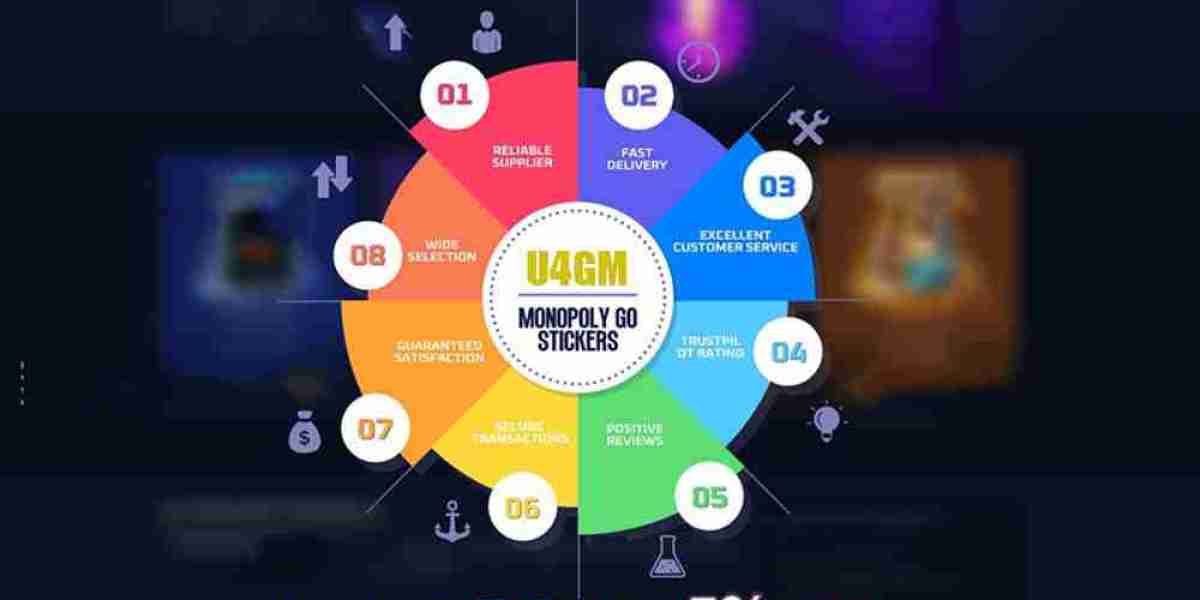

BePick stands out as a comprehensive useful resource for people thinking about immediate loans online. The web site presents detailed data on numerous lending options, comparing options, interest rates, and phrases from different providers. This makes it easier for borrowers to make knowledgeable selections tailored to their monetary circumstan

Additionally, Bepec features helpful tools, similar to debt consolidation calculators that help users project potential financial savings and month-to-month cost quantities. This emphasizes the significance of **making informed monetary decisions**. Such resources can be invaluable for borrowers in search of both steering and transparency of their choi

After submission, lenders typically conduct a background examine, and if permitted, you may access funds inside hours. However, be cautious about the terms and situations before finalizing any loan agreem

Understanding Debt Consolidation Loans

Debt consolidation loans are monetary instruments designed to combine a quantity of money owed into a single mortgage. This course of usually includes taking out a new loan with a decrease rate of interest to pay off present money owed, allowing debtors to have only one monthly cost. This can simplify budgeting and doubtlessly reduce total pri

Once an acceptable lender is identified, the applicant will fill out an utility form, which may require personal, financial, and employment data. Timely submission of any requested documentation can expedite the evaluation process. After submitting the application, the lender will evaluate the loan request and will conduct a credit score examine before offering an approval decis

Furthermore, BePick retains its content material updated, ensuring that users have entry to the most recent information on rates of interest, mortgage tendencies, and lending practices. The platform acts as a dependable useful resource for anybody contemplating installment loans, particularly for these navigating challenges because of unfavorable credit rati

Unfortunately, the stigma surrounding bad credit could discourage potential borrowers from exploring their options. It's important to recognize that many lending institutions concentrate on providing installment loans to these with less-than-perfect credit histories, though the corresponding interest rates may replicate the perceived monetary threat. Careful comparability amongst these lenders can result in better rates and

Emergency Fund Loan te

Repayment Strategies for Borrowers

Once a borrower secures an instant mortgage, formulating a repayment technique is crucial for managing monetary well being. One efficient methodology is to create a clear budget that prioritizes loan repayments. By analyzing revenue and expenses, debtors can allocate essential funds for well timed funds and avoid further monetary str

You'll Never Be Able To Figure Out This Togel4d Login's Benefits

Tarafından Merrill Heydon

You'll Never Be Able To Figure Out This Togel4d Login's Benefits

Tarafından Merrill Heydon Claim Your 1Win Sports Rewards Code 2025 Now

Tarafından Brad Bruen

Claim Your 1Win Sports Rewards Code 2025 Now

Tarafından Brad Bruen Jak znaleźć najlepsze bonusy w kasynach online

Tarafından Arthur93ART ART

Jak znaleźć najlepsze bonusy w kasynach online

Tarafından Arthur93ART ART BetWinner Promo Code for Fast Sportsbook Rewards

Tarafından Brad Bruen

BetWinner Promo Code for Fast Sportsbook Rewards

Tarafından Brad Bruen Видеочат рунетки бесплатно.

Tarafından Felisha Cockle

Видеочат рунетки бесплатно.

Tarafından Felisha Cockle